- Howie Fenton

- |

- June 13, 2023

The printing industry continues to grapple with the lingering effects of the pandemic, which have led to an acceleration in changes and advancements. In January 2023, we released what has become a popular blog post called "11 Predictions of How Print Industry Trends Will Impact Your Business in 2023" focusing on the rapidly changing trends in the printing industry. Due to the interest in that post, we thought it would be a good time to provide an updated analysis and evaluate the accuracy of our previous predictions. You might be surprised how well we did!

Updated Predictions of The Impact of Print Industry Trends Will Have on Print Centers

#1 Paper supply will remain an issue but much less so.

According to the PRINTING United Alliance "State of the Industry Update for Q1 2023", this trend has borne out. According to Andy Paparozzi, reports from his panel show that availability has increased in all substrates. According to the report, most expect significant improvements in the first half of 2023 (26%) or the second half of 2023 (31%).

#2 Staffing challenges will persist, but strategies will ease the effects.

The same PRINTING United Alliance "State of the Industry" study reports that this is accurate. “Expectations for full-year 2023 have improved since last fall. Companies forecasting improvement expect “labor shortages, material shortages, and inflation to ease.” One of the study participants reported, “We have also reallocated our labor to reduce office staffing and increase production staffing, resulting in an ability to produce more revenue at lower cost in the same amount of time.”

#3 Generation Z employees will reshape recruitment and management strategies.

An article entitled “Recruiting and Retaining Printing’s Up-and-coming Workforce Can Require More Than a Job Posting” on the PRINTING United Alliance website agrees with the trend of different recruitment and management strategies. Author Donna Painter wrote, “The takeaway for print business owners and managers is that Gen Z is not already working in our industry. Based on their age and generational trends, most of them are not yet employed full-time. Think about this: if you are considering hiring a customer service representative early next year, that future employee is probably a student in a university or technical college program today. Or maybe you recognize that your production employees are edging toward retirement over the next three years — their replacements are high school sophomores and juniors right now. This means that if you really want to hire Gen Z, the best place to look for them is at school.”

#4 The trend towards the unification of design, prepress, and web services staff is increasing.

Support for this trend is difficult to find because few directly discuss this unification or consolidation of job functions. But we still see this trend in companies struggling to hire prepress staff or reluctant to outsource IT or Web services staff. We see designers preflight and correct customer files and build pages for Web to Print customers.

While not discussed directly, this unification or consolidation of job functions is part of the cross-training labor trend. More and more companies are recognizing the benefits of cross-training and are actively pursuing cross-training programs. The importance of cross-training has increased with the labor shortage because many companies can’t find skilled labor. That is why we have seen designers adding prepress skills to their resumes. For more information about the benefits of cross training, read “9 Major Benefits of Cross-Training Employees Effectively”. For more on consolidating job responsibilities, read “Job consolidation: How to merge positions effectively” from Insperity.

#5 Digital print volumes will increase and reach a plateau.

There is a great deal of information about the growth of digital, and most have predictions similar to ours. According to MarketsandMarkets, the global Digital printing market in terms of revenue was estimated to be worth $24.8 billion and is poised to reach $34.3 billion by 2026, growing at a CAGR of 6.7%.

#6 Offset printing's reign will continue to wane.

Market researchers agree and report that offset printing is declining as digital increases. Marco Boer reported in a Printing Impressions article that total offset pages have been down nearly 50% since 2012. Smither's report entitled "The Future of Digital vs. Offset Printing to 2027" reports that: “Between 2022 and 2027, the analog printing industry is expected to witness a growth rate of 0.8% while the digital printing industry is expected to witness a growth rate of 5.7%”, “Digital (toner and inkjet) process will see the fastest growth across 2017-2022” and that “The previously dominant offset litho will decline in terms of value.”

#7 The decrease in social distancing will reduce the demand for wide format printing.

According to a webinar by Richard Romano and Cary Sherburne from WhatTheyThink.com, this prediction is accurate. In the webinar, it was reported that print signage did increase in 2021-2022 and is expected to reach 10 billion meters in 2023, but the upward trajectory is now leveling off. One possible bright spot is the reemergence of floor graphics in a new market. An article in WhatTheyThink.com by Heidi Tolliver-Walker discusses how businesses and retailers are embracing floor graphics. What is driving this trend, you may ask? She suggests it may be because so many shoppers are looking down at their phones.

#8 The ongoing digital revolution will reduce overall print volumes.

According to an IBISWorld Study, “Printing in the US - Market Size 2005–2029,” the market size of the printing industry in 2012 was approximately $113 B, and in 2022, it was roughly $83 B illustrating a decline of 3.4% in 2023. The question, is however, is the decline due to the digital revolution? To answer this question, think about the following. Is there growth in newspapers or magazines, or are people reading the news on their phones, tablets, or via radio and TV news stations? Are companies that provide bills and statements encouraging or discouraging you to switch to electronic alternatives? Are offices printing more or fewer business documents and sending more documents electronically? The motivation and alternatives to print are increasing in almost every part of our lives.

#9 Investing in inkjet printing presses continues to grow.

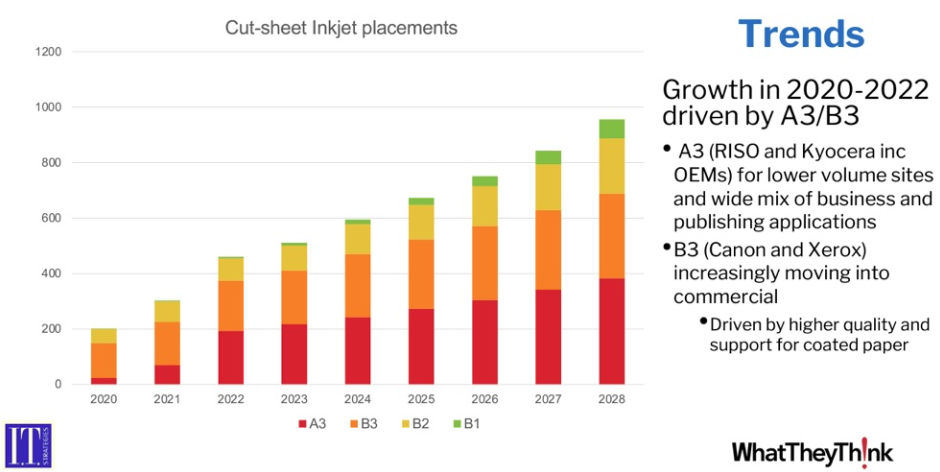

In a presentation on WhatTheyThink.com entitled "Digital Printing Technology Outlook", Ralf Schlözer shared a slide from IT Strategies showing the ongoing and predicted growth of new cut sheet inkjet printer equipment placements. As you can see below, the growth is steady.

#10 Outsourcing in-plant services faces an escalating threat.

Bob Neubauer, the editor of In-Plant Impressions, seems to agree with our prediction. A recent article, “From the Editor: Old Threat, New Angle” discusses the reemergence of the outsourcing trend. According to Neubauer, “Twice now, I have read or heard messages from industry analysts encouraging commercial printers to look more ravenously at in-plants and to try harder to take work from them. Their logic is as follows: Insurance companies, government agencies, universities, and many other entities have embraced a work-from-home model, with many of their employees not likely to return to the office full-time. This enables these companies and organizations to downsize their real estate and the number of printed support materials their remote employees need. So those organizations, according to these theorists, are now looking to outsource printing to external print service providers. The authors of these directives painted in-plants as easy prey and their parent organizations as being eager to outsource due to pandemic-related business changes.”

#11 The demand for productivity-boosting products will remain high.

The PRINTING United Alliance "2023 State of the Industry " report data fully agrees with this prediction. The report lists the three top investment objectives as: 1) tools to increase productivity/efficiency (82%), 2) increasing production speed (53%), and 3) automating operations (52%). The report also lists the most desired investments: e-commerce solutions to expand market reach and extend automation to the client; workflow software to produce more quickly and efficiently; and applications such as management information systems (MIS), customer relationship management (CRM), and enterprise resource planning (ERP) to capture internal and external market intelligence were among the top five most desired investments.

With New Challenges Come New Opportunities

The printing industry is experiencing a mixed landscape of trends and challenges. Although certain obstacles like paper usage and volume declines are gradually diminishing, others persist, including an overall reduction in volume, staffing concerns, and increased threat of outsourcing. Additionally, specific challenges such as the continued decline in offset and the recruitment of Gen Z pose new hurdles. However, amidst these challenges, new opportunities are emerging. The industry is witnessing the continued rise of productivity software, unification / job consolidation, and notable growth in digital, inkjet, and wide format printing. These developments signify a shift towards enhanced efficiency and expanded possibilities within the printing industry.

Let's Talk More about Leveraging the Opportunities from These Trends

Reach out to me at any time at howiemfenton@gmail.com to talk more.